The Way To Calculate And Use The Allowance For Doubtful Accounts

This means they didn’t correctly estimate their potential unhealthy money owed, resulting in overstated belongings, inflated net income on the income statement, and an inaccurate understanding of their financial well being. Assuming a few of your customer credit balances will go unpaid, how do you determine what is an inexpensive allowance for uncertain accounts? The allowance for doubtful accounts is recorded as a contra asset account beneath the accounts receivable on a company’s balance sheet. If you employ the accrual basis of accounting, you will report doubtful accounts in the identical accounting period as the original credit score sale. This will assist current a extra realistic picture of the accounts receivable quantities you expect to collect, versus what goes under the allowance for uncertain accounts.

Analysis from Dun & Bradstreet in Q suggests that the commercial manufacturing sector, for instance, generally collects 70% or extra invoices on time. The wholesale commerce sector also experiences on-time funds for probably the most part, with some exceptions like medical product distribution. Development is notorious for lengthy credit cycles, and collection cycle knowledge displays this reality. When accumulating an bill appears unlikely, AFDA is credited, and bad debt expense debited.

In addition, this accounting process prevents the big swings in working results when uncollectible accounts are written off immediately as unhealthy debt expenses. For instance, say a company lists a hundred allowance for doubtful accounts clients who purchase on credit, and the total quantity owed is $1,000,000. The purpose of the allowance for doubtful accounts is to estimate what quantity of customers out of the 100 won’t pay the complete amount they owe. Somewhat than ready to see precisely how payments work out, the corporate will debit a foul debt expense and credit allowance for uncertain accounts.

Automate Monitoring And Reporting To Reinforce Efficiency

Analysing this knowledge helps businesses establish potential dangers and alternatives for improvement. The danger classification methodology includes assigning a danger rating or danger category to every buyer based mostly on criteria—such as cost history, credit score score, and trade. The firm then uses the historical percentage of uncollectible accounts for each risk class to estimate the allowance for doubtful accounts.

By analysing past developments in buyer fee behaviours and bad debt occurrences, companies can develop reliable estimates. Factors similar to trade standards, financial conditions, and specific customer circumstances also needs to be considered to refine these projections. By estimating the anticipated uncollectible debts and creating an allowance for them, you possibly can minimize the danger of great losses arising from bad debts and ensure correct monetary statements. When a enterprise makes credit score gross sales, there’s a chance that a few of its clients won’t pay their bills—resulting in uncollectible money owed.

In other words, if an amount is added to the “Allowance for Doubtful Accounts” line merchandise, that quantity is at all times a deduction. Generally, even in accounting, there are welcome surprises, e.g., when a beforehand written-off account pays unexpectedly. Maybe a customer emerges from chapter with some capacity to pay, or a collections agency succeeds after the account was deemed hopeless.

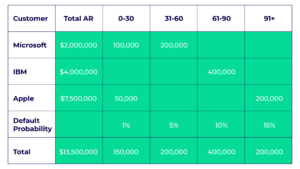

The projected unhealthy debt expense is matched to the identical period because the sale itself in order that a more accurate portrayal of income and expenses is recorded on monetary statements. Corporations in industries with greater credit threat or longer collection cycles typically have larger allowances for doubtful accounts. The accounts receivable getting older methodology is a report that lists unpaid buyer invoices by date ranges and applies a rate of default to every date range. The allowance for uncertain accounts is an organization’s educated guess about how much customers owe that will never are available.

- Let’s assume that a company has a debit balance in Accounts Receivable of $120,500 as a end result of having offered items on credit score.

- As a rule of thumb, the longer your collection cycle is, the larger your allowance for uncertain accounts have to be to account for elevated dangers.

- We will discover the definition and purpose of this allowance, look at its influence on monetary statements, and focus on the frequent methods used to estimate doubtful accounts.

- Take your small business to the subsequent degree with seamless international payments, native IBAN accounts, FX companies, and more.

Allowance For Doubtful Accounts: Every Thing To Find Out About Doubtful Accounts

By factoring in these potential dangers, CFOs can more effectively project budgets and plan investments. The allowance for doubtful accounts isn’t at all times a debit or credit score account, as it can be both depending on the transactions. When a doubtful account turns into uncollectible, it is a debit steadiness in the allowance for doubtful accounts. Yes, GAAP (Generally Accepted Accounting Principles) does require corporations to hold up an allowance for uncertain accounts. In Accordance to GAAP, your allowance for doubtful accounts should precisely replicate the company’s assortment historical past.

With that in mind, it is useful to take a look at late payment statistic by trade to gain an idea of where your group falls. Recovering an account might contain working with the debtor immediately, working with a collection agency, or pursuing authorized action. An AR automation platform with clever collections capabilities might help you keep on top of your collections so that overdue invoices don’t go past the purpose of no return. However, you’ll wish to do every thing in your energy to stop receivables from changing into uncollectible before things get to that point. You can use your AR getting older report that will assist you calculate AFDA by making use of an expected default price to every aging bucket listed in the report. As a lot as you would love to gather on each invoice you issue, that doesn’t always happen.

This allowance is a key a half of the accrual accounting technique, making certain that a company’s financial statements mirror a sensible view of its monetary well being. When a business sells items or companies on credit, it data accounts receivable, representing the cash owed by prospects. To account for this uncertainty, corporations put aside an allowance for uncertain accounts, which reduces the gross accounts receivable steadiness to a extra correct web realizable worth. The allowance for doubtful accounts (ADA) is a financial reserve that companies put aside to cover anticipated unhealthy money owed from prospects who fail to pay their invoices. This reserve helps companies preserve accurate monetary reporting by accounting for potential losses before they occur. Therefore, the income assertion is delaying the reporting of unhealthy debts expense on its revenue statement until an account receivable is actually written off as uncollectible.

Journal Entries

This method is simple to apply and perceive, making it suitable for companies with relatively stable and predictable sales patterns. A Finance Professional specializing within the areas of Credit Score Management, Fee Processing, Collections and Accounts Receivable. Possessing over 20 years’ experience https://www.personal-accounting.org/ within the area managing giant global groups with a robust concentrate on bettering efficiency throughout the Order to Cash cycle. Hailed as an trade skilled within the subject, Sarah-Jayne makes lively appearances within the space, incessantly that includes on thought-leading panels and discussions.